NQXT is a highly efficient and cash generating asset that will consolidate APSEZ’s presence along the East-West trade corridor, in line with its global expansion strategy

- North Queensland Export Terminal (NQXT) is a critical export gateway for producers in resource-rich Queensland, Australia and has current capacity of 50 MTPA.

- NQXT has an identified pathway and capability to grow throughput up to 120 MTPA to meet the global demand for Queensland’s high quality resources including for potential green hydrogen exports.

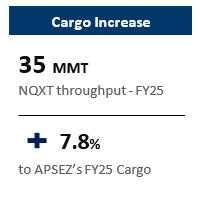

- NQXT handled its all-time high cargo at 35MMT in FY25.

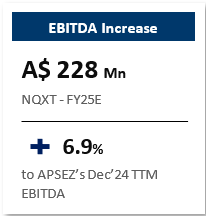

- APSEZ will benefit from incremental EBITDA margin in excess of 90%.

- NQXT EBITDA to grow to A$ 400 million within 4 years.

- NQXT lease has a long remaining life of 85 years until year 2110.

- As part of a non-cash transaction, APSEZ will issue 14.38 crore equity shares under preferential allotment route to the seller, which will result in a net increase of 2.13% in promoter group holding.

- The transaction will further enhance APSEZ’s global transport and logistics footprint and fast track its journey to handle 1 billion tonnes per annum by 2030.

- NQXT comes with an excellent ESG track record with minimal environmental footprint, diverse workforce, strong safety standards, 50% operational spend with local and regional suppliers.

Editor’s Synopsis

Ahmedabad, 17 April, 2025: The Board of Directors of Adani Ports and Special Economic Zone Ltd. (APSEZ), India’s largest integrated Transport Utility company has approved the acquisition of Abbot Point Port Holdings Pte Ltd (APPH), Singapore from Carmichael Rail and Port Singapore Holdings Pte Ltd, Singapore (CRPSHPL). CRPSHPL is a related party.

APPH holds the entities which own and operate the North Queensland Export Terminal, a dedicated export terminal with a current nameplate capacity of 50 million tonnes per annum (MTPA). The terminal is located at the Port of Abbot Point, approximately 25 km north of Bowen, in North Queensland on Australia’s east coast.

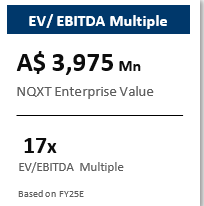

The transaction will be completed on a non-cash basis. APSEZ will issue 14.38 crore equity shares to CRPSHPL, in exchange for acquisition of 100% interest in APPH. This is based on enterprise value of NQXT of A$ 3,975 million. As part of the transaction, APSEZ will also assume other non-core assets and liabilities on APPH’s balance sheet, which APSEZ will realize within a few months of the acquisition (zero net impact on the transaction valuation). APSEZ’s leverage will remain at similar levels post the transaction.

Speaking on the acquisition, Mr. Ashwani Gupta, Whole-time Director & CEO, APSEZ, said, NQXT’s acquisition is a pivotal step in our international strategy, opening new export markets and securing long-term contracts with valued users. Strategically located on the East-West trade corridor, NQXT is poised for robust growth as a high-performing asset, driven by increased capacity, upcoming contract renewals in the medium term, and the potential for green hydrogen exports in the long term. We are targeting EBITDA growing to A$ 400 million within 4 years. I am proud to welcome NQXT to our 'Growth with Goodness' initiative, as it exemplifies our commitment to high standards in environmental, social, and governance practices.”

About NQXT

NQXT, is a natural deep-water, multi-user export terminal with a nameplate capacity of 50 million tonnes per annum. NQXT is located in the Port of Abbot Point, approximately 25 km north of Bowen, in North Queensland on Australia’s east coast. The Port of Abbot Point (within which NQXT is located) has been declared as a Strategic Port and a Priority Port Development Area by the Queensland Government. NQXT is under a long-term lease from the Queensland Government and is a critical infrastructure asset supporting Australia’s significant resource industry. NQXT provides strategic access to currently eight major customers under long term “take or pay” contracts. NQXT’s operations contributed A$ 10 billion to Queensland’s Gross State Product and facilitated 8,000 jobs across mining and other industries.

During FY25, NQXT had a contract capacity of 40MMT and handled all-time high cargo volume of 35MMT. The weighted average mine life the NQXT’s current users is c. 60 years. Cargo from NQXT was exported to 15 countries including 88% to Asia and 10% Europe. NQXT posted FY25E A$ 349 million revenue and EBITDA of A$ 228 million (incremental EBITDA margin in excess of 90% for APSEZ, excluding pass-through O&M cost included in the revenue).

)

Key rationale for the NQXT acquisition

- A fully operational multi-user export facility which provides strategic access to resource producing customers, with demonstrated operating history of over 4 decades.

- High quality customer base which operate in the Bowen and Galilee mining basins and produce high-quality metallurgical and energy coal for export to over 15 countries globally.

- Poised for EBITDA growth on the back of growing contracted capacity, renewal of existing contracts and further group synergies under APSEZ’s global transport and logistics platform.

- Strategic fit with APSEZ’s strategy of global expansion and leverage on the potential for future green hydrogen exports from the Port of Abbot Point, in line with the Queensland Government’s strategy.

ESG

Since the commencement of operations in 1984, NQXT has been on a journey of continuous improvement and sustainability. With zero reportable environmental incidents during FY25, zero fatalities, and a lost time injury frequency rate of 1.7, operations at the terminal have delivered excellent safety standards. The business has been extensively involved in community development with 50% of FY25 operational spend with local and regional suppliers and A$ 2.4 million spent since 2017 on community initiatives in Bowen and Collinsville. Over 5% of the terminal’s workforce identify as Aboriginal and Torres Strait Islander, higher than proportion of First Nations people in the Australian population.